Checking Accounts

Compare Our Checking Accounts

| Basic Checking | Rewards Checking | Prime Checking | Rising Checking | |

|---|---|---|---|---|

| **APY | % | 3.25 (when qualifications are met) | % | % |

| MIN. OPENING DEPOSIT | $50.00 | $50.00 | $50.00 | $25.00 |

| MONTHLY FEES | None | None | $6.00 | $5.00 |

| BENEFITS | No monthly service fee. Courtesy Pay and Overdraft Services | Earn 3.25% APY and get ATM refunds up to $15.00 per month when qualifications are met¹ | Travel, accidental death insurance, cell phone protection, roadside assistance, and more! | Help repair your checking history. No minimum balance required. |

Basic Checking

Manage your money securely and responsibly with our Basic Checking Account.

Benefits:

Only $50.00 minimum initial deposit

No monthly service fee or minimum balance required

Unlimited check writing with no per-check fee

Courtesy Pay and Overdraft Transfer services*

Access your account anytime and anywhere with CSE Online and Mobile Banking

*Some restrictions apply

Rewards Checking

CSE Rewards Checking is an upgrade from our Free Basic Checking. You can enjoy all the perks of our Free Basic Checking while earning amazing dividends!

Benefits:

Earn 3.25% APY¹ when qualifications are met

Get nationwide ATM fee refunds up to $15.00 per month when qualifications are met¹

Qualifying is CSEasy:

Have at least 14 debit card transactions post and clear per qualification cycle

Have at least one Direct Deposit, ACH Debit, or Bill Pay post and clear per qualification cycle

Access CSE Online or Mobile Banking

Enroll in eStatements

Prime Checking Powered by BaZing

Prime Checking gives members with a checking account access to numerous discounts and services through BaZing.

Benefits:

Ability to access more than 450,000 discounts and special offers on goods and services you use the most

Automatic enrollment into some offerings just for having a Prime Checking Account

You choose what you want to utilize

Offerings:

Save at the gas pump with BaZing Fuel

Travel Accidental Death Insurance*

Shop local, save local with BaZing Savings

Health Savings Card

Cell Phone Protection*

Roadside Assistance

ID Theft Aid

Rising Checking

With just a few limitations to start, Rising Checking can help you rise from your less-than-perfect checking and financial record.

Benefits:

Help repair your checking history

No minimum balance required

Access your account anytime and anywhere with CSE Online and Mobile Banking

Need to know:

Only $25.00 to open

Low monthly charge of $5.00

After 12 months, you're eligible to apply for one of our other checking accounts

Checking Rates

Last Declaration Date: February 24, 2026

| Account Type | Dividend Rate | APY** | Min. Opening Deposit |

|---|---|---|---|

| Basic Checking | % | % | $50.00 |

| Rewards Checking Qualifications met (Balance ≤20,000.00) |

% | % | $50.00 |

| Rewards Checking Qualifications met (Balance ≥20,000.01) |

% | % | $50.00 |

| Rewards Checking Qualifications not met |

% | % | $50.00 |

| Prime Checking | % | % | $50.00 |

| Rising Checking | % | % | $25.00 |

Resources

How to Set Up Direct Deposit

THIS INFORMATION IS PROVIDED FOR THE USE OF MEMBERS BELONGING TO CSE FEDERAL CREDIT UNION, LOCATED IN LOUISIANA.

Would you rather not wait in long lines to make deposits?

With Direct Deposit, you can automatically deposit:

Paychecks

Social Security Checks

Pension Checks

Government Checks

Tax Refunds

The payor will need your account number, type of account (checking or savings), and the ABA/Routing Number of CSE Federal Credit Union (located in LOUISIANA): 265274859.

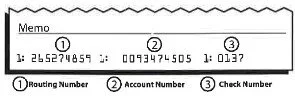

How to interpret my account numbers?

First number: Routing number

Second number: Account number

Third number: Check number

Do you need to provide your account number to a Merchant or to your Tax Advisor for a direct deposit or for a purchase?

To avoid your transaction being rejected or delayed, the following format should be used for your account(s);

Your Share Savings Account number may have as few as 3 digits but no more than 6

Your Checking Account number is the MICR number as shown on your checks (ex: 123456714)

Your Money Market Account is the MICR number as shown on your checks and must be coded as a Checking Account

If a form requires a specific number of digits, you can simply put zeros BEFORE the account number. (ex: 00123456 for savings and 00123456714 for checking)