Savings Accounts

Share Savings

If you are eligible for membership, all you need to do is open a Share Savings Account to become a member of CSE. Get started with a $5.00 minimum deposit today!

Share Savings Complimentary Perks:

Earn dividends on a monthly balance of $5.00 or more

Visa Debit Card – used to access funds at an ATM only (not for POS transactions)

Access your account anytime and anywhere with CSE Online and Mobile Banking

No monthly service fee

Unlimited in-person withdrawals

Christmas Club

The holidays are supposed to be a time of joy and celebration. But too many of us find them to be a time of great financial stress as well. Take that stress out with a Christmas Club Account from CSE.

What you need to know:

Only $25.00 to open and maintain the account

No minimum monthly deposit

Earns monthly compounded dividends

Funds are distributed in October, just in time for the holidays

Boost savings with automatic transfers

Share Savings Rates

Last Dividend Declaration Date: February 24, 2026

Christmas Club Rates

Last Dividend Declaration Date: February 24, 2026

| Dividend Rate | APY** | Min. Opening Deposit | Min. Balance to Avoid a Service Fee | Min. Balance to Earn the Stated APY |

|---|---|---|---|---|

| % | % | $25.00 | $25.00 | $25.00 |

Discover More

Resources

How to Set Up Direct Deposit

THIS INFORMATION IS PROVIDED FOR THE USE OF MEMBERS BELONGING TO CSE FEDERAL CREDIT UNION, LOCATED IN LOUISIANA.

Would you rather not wait in long lines to make deposits?

With Direct Deposit, you can automatically deposit:

Paychecks

Social Security Checks

Pension Checks

Government Checks

Tax Refunds

The payor will need your account number, type of account (checking or savings), and the ABA/Routing Number of CSE Federal Credit Union (located in LOUISIANA): 265274859.

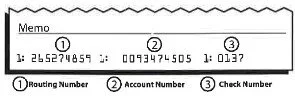

How to interpret my account numbers?

First number: Routing number

Second number: Account number

Third number: Check number

Do you need to provide your account number to a Merchant or to your Tax Advisor for a direct deposit or for a purchase?

To avoid your transaction being rejected or delayed, the following format should be used for your account(s);

Your Share Savings Account number may have as few as 3 digits but no more than 6

Your Checking Account number is the MICR number as shown on your checks (ex: 123456714)

Your Money Market Account is the MICR number as shown on your checks and must be coded as a Checking Account

If a form requires a specific number of digits, you can simply put zeros BEFORE the account number. (ex: 00123456 for savings and 00123456714 for checking)