Understanding Credit Scores: What They Are and What Impacts Them

Your credit score is more than just a number—it’s a snapshot of your financial health. Whether you're applying for a loan, financing a car, or even signing up for utilities, your credit score can influence the opportunities available to you and how much you pay in interest. That’s why it’s important to understand what makes up a credit score and what you can do to improve it.

What Is a Credit Score—and Why Does It Matter?

A credit score is a three-digit number that reflects your financial reliability, specifically your history of managing borrowed money. It acts as a summary of your creditworthiness, helping lenders, landlords, and even utility companies make informed decisions about whether to do business with you.

Most credit scores fall between 300 and 850, with higher numbers indicating stronger credit. Generally:

750 and above is considered excellent

700-749 is good

650-699 is fair

below 650 may make borrowing more difficult or more expensive

But credit scores don’t just impact whether you get approved for a loan or credit card—they also influence how much you pay in interest, your monthly payments, and even how much you can borrow. A good score can lead to better terms, lower rates, and more financial flexibility, while a low score can limit your options and cost you more over time.

Your credit score can also affect your everyday life in less obvious ways. Some employers check credit history as part of the hiring process, and many landlords use it to evaluate rental applications. Even insurance companies may use credit-based scores to determine your premiums.

In short, your credit score plays a key role in your overall financial well-being—so understanding it is the first step toward taking control of your future.

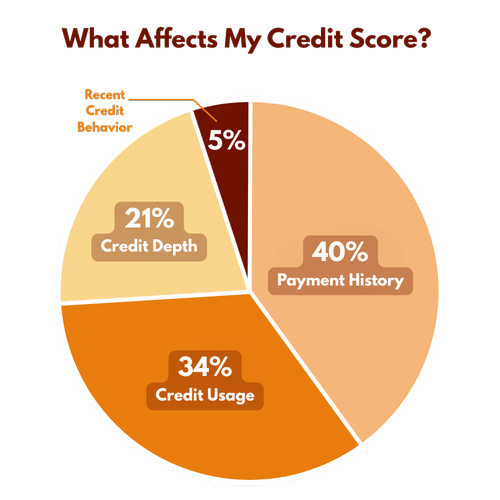

What Makes Up Your Credit Score?

TransUnion, one of the three major credit bureaus, uses four key factors to calculate your credit score:

Credit Usage

This measures how much of your available credit you’re currently using. It’s also known as your credit utilization ratio. Keeping your usage below 30% of your total credit limit is generally recommended. Using too much available credit can signal financial distress, even if you’re making payments on time.

Credit Depth

Also referred to as your credit mix, this factor considers the variety of credit accounts you’ve managed—such as credit cards, installment loans, and mortgages. A healthy mix shows that you can handle different types of credit responsibly. Length of credit history also plays a role here; accounts that have been open for a longer time can positively impact your score.

Credit Behavior

This looks at how often you apply for new credit. Each time you apply, a "hard inquiry" is added to your report, which may temporarily lower your score. Multiple inquiries in a short time can be a red flag, so it’s best to apply for credit only when necessary.

Payment History

Your track record of paying bills on time is one of the most heavily weighted factors in your score. Late or missed payments can stay on your credit report for up to seven years. Consistent, on-time payments build trust and demonstrate reliability.

How Can I Improve My Score?

Improving your credit score starts with understanding where you stand—and that’s where CSE can help.

CSE’s free Credit Score service, available through online and mobile banking, gives Members the tools to track and improve their score over time. You can check your credit report regularly, get tips personalized to your credit profile, and simulate how financial decisions might impact your score—all in one place.

Whether you’re just getting started or working toward a higher score, CSE is here to support you every step of the way.